Some Known Questions About Best Broker For Forex Trading.

Some Known Questions About Best Broker For Forex Trading.

Blog Article

The Best Broker For Forex Trading Statements

Table of ContentsGetting The Best Broker For Forex Trading To WorkNot known Details About Best Broker For Forex Trading Best Broker For Forex Trading for BeginnersAll about Best Broker For Forex TradingFascination About Best Broker For Forex Trading

Regional pairs involve currency sets within the very same region. For instance, AUD/NZD (Australian Dollar/New Zealand Dollar) is an Australasia regional set. One money set an individual may intend to profession is the EUR/USD. If this particular pair is trading for 1.15 pips, and they think the exchange rate will certainly enhance in value, they might purchase 100,000 euros worth of this money pair.Usually, foreign exchange markets are closed on weekends, yet it's possible some capitalists still trade during off-hours. With the OTC market, purchases can take place whenever 2 events are ready to trade.

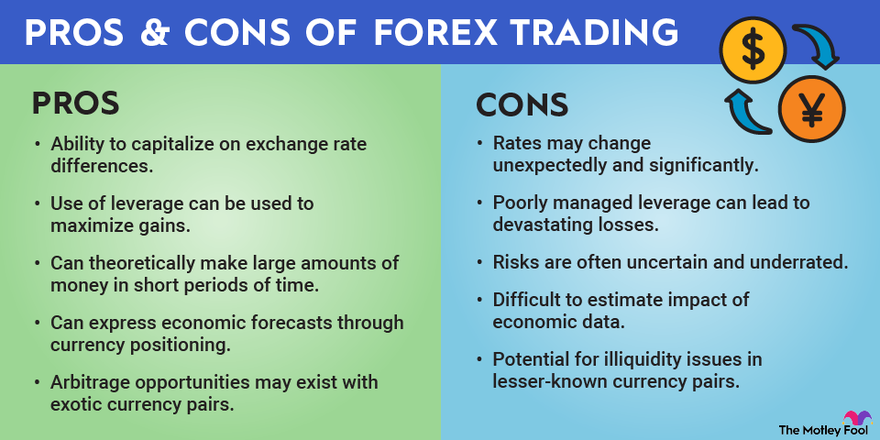

In finding out foreign exchange trading strategies for novices, numerous retail financiers obtain attracted by the very easy access to utilize without recognizing all the subtleties of the market, and take advantage of could intensify their losses. For those who make a decision to take part in foreign exchange trading, there are several strategies to choose from.

Broadly, foreign exchange trading strategies, like various other forms of investing, normally fall under a couple of camps: technical evaluation or fundamental analysis (Best Broker For Forex Trading). Along with basic analysis vs. technical evaluation, foreign exchange trading can also be based upon time-related professions. These might still be based on basic or technological analysis, or they could be more speculative gambles in the hopes of making a quick earnings, without much analysis

Best Broker For Forex Trading Fundamentals Explained

Some time-based trading strategies include: Day trading entails acquiring and selling the same position within the same day. For example, if you day trade the EUR/USD pair, you may first purchase the setting at a price of 1.10 and sell it later that day for 1.101 for a small gain.

A trader could observe that there's been recent momentum in the euro's stamina vs. the U.S. dollar, so they could get the EU/USD pair, in the hopes that in a week or so they can offer for a gain, before the energy fizzles. Placement trading usually indicates long-lasting investing, instead of short-term supposition like with day trading, scalping, or swing trading.

The Basic Principles Of Best Broker For Forex Trading

dollars, creating the price of USD to obtain vs. JPY. Even if there's no noticeable underlying financial reason the united state economic climate ought to be viewed a lot more positively than the Japanese economic climate, a technological evaluation could determine that when the USD gains, claim, 2% in one week, it tends to boost another 2% the complying with week based upon momentum, with financiers piling onto the profession for fear of losing out.

Remember that these are hypotheticals, and different financiers have their very next own ideas when it involves technological analysis. Rather than technological evaluation that bases forecasts on past rate movements, fundamental analysis checks out the underlying economic/financial reasons that a possession's cost might change. As an example, fundamental analysis might wrap up that the united state

If that takes place, after that the USD might gain strength versus the euro, so a foreign exchange capitalist making use of fundamental analysis could attempt to obtain on the best side of that trade. An additional basic evaluation element could be interest rates. If united state rates of interest are anticipated to drop faster than the EU's, that might create capitalists to favor purchasing bonds in the EU, thereby increasing need for the euro and weakening need for the buck.

Once again, these are simply hypotheticals, but the point is that basic evaluation bases trading on underlying factors that drive costs, besides trading task. Best Broker For Forex Trading. In addition to finding out the right foreign exchange trading technique, it is necessary to choose a solid forex broker. That's due to the fact that brokers can have different rates, such as the spread they charge between buy and offer orders, which can reduce right into prospective gains

While foreign exchange trading is generally less strictly controlled than supply trading, you still intend to choose a broker that follows appropriate guidelines. In the United state, you could look for a broker that's regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). You additionally desire to review a broker's safety methods to make certain that your cash is secure, such as inspecting whether the broker sets apart customer funds from their own and check over here holds them at controlled banks.

Unknown Facts About Best Broker For Forex Trading

This can be subjective, so you might wish to try to find a broker that provides demo accounts where you can obtain a feeling of what trading on that particular system resembles. Various brokers may have various account kinds, such as with some geared extra towards beginner retail financiers, and others toward even more expert traders.

Some have no minimum deposit, while others begin at around $100. The amount you choose to begin with relies on your general financial circumstance, including your total capital and threat tolerance. Yes, foreign exchange trading can be dangerous, especially for specific financiers. Financial institutions and other institutional capitalists often have an educational benefit over retail investors, which can make it harder for individuals to make money from forex trades.

Report this page